Are there still capital gains to be made from flipping properties?

House flipping is a common way to make an extra buck for many New Zealanders. This often involves buying the cheapest house on the street, adding a lick of paint and some minor reno’s, and selling for a profit.

This month, the homes.co.nz team took a look at a few examples of property owners who have made a quick buck and the areas around the country where the highest capital gains are seen.

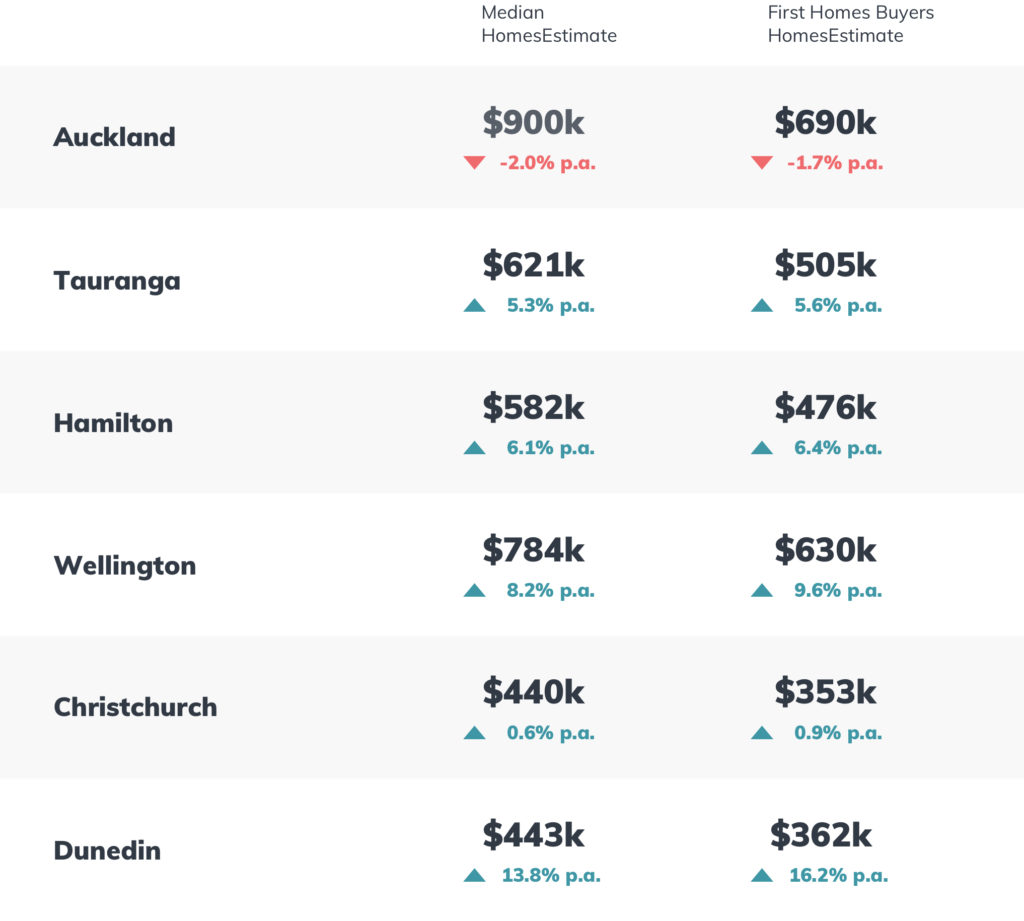

The table below shows the typical gains seen for properties that were bought and sold within the last two years in New Zealand.

Although New Zealand does not have a capital gains tax, there is some legislation known as the ‘bright line property tax’ that potential investors should be aware of. Especially if you are generating capital gains similar to the property’s above!

The bright-line rule in New Zealand is very straightforward. It says you’ll pay tax when you buy and sell a residential property within five years unless an exclusion applies.

There are three exclusions to this rule:

- if it’s your family/main home

- if you inherited the property

- if you’re the executor or administrator of a deceased estate

The big exclusion here is for the family home. This means that you generally will not have pay tax when you sell your main home, but you may be liable for additional taxes if you are an investor. Take a look at IRD’s website for more information.

Monthly HomesEstimate Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s November 2019 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

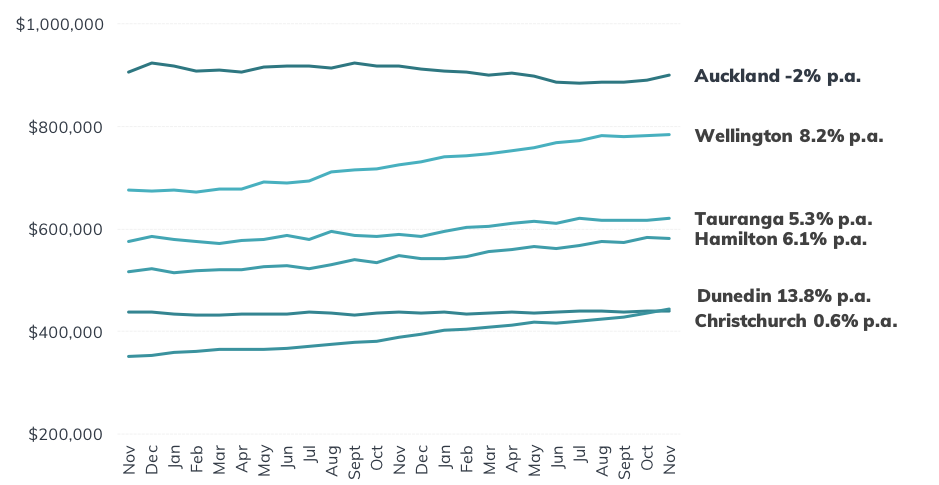

Trends in our Main Cities

Dunedin, for the first time, has gone past Christchurch with the median HomesEstimate increasing to $443k. Dunedin has seen a steady increase of 13.8% per annum while Christchurch remains flat with a median HomesEstimate of $440k.

There are also signs that the status quo may be changing elsewhere in the country. Auckland has seen values increasing this month to $900k (although still down 2% from this time last year) and growth is slowing in Wellington, Tauranga and Hamilton.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s November 2019 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.