Where did property prices grow the most last decade?

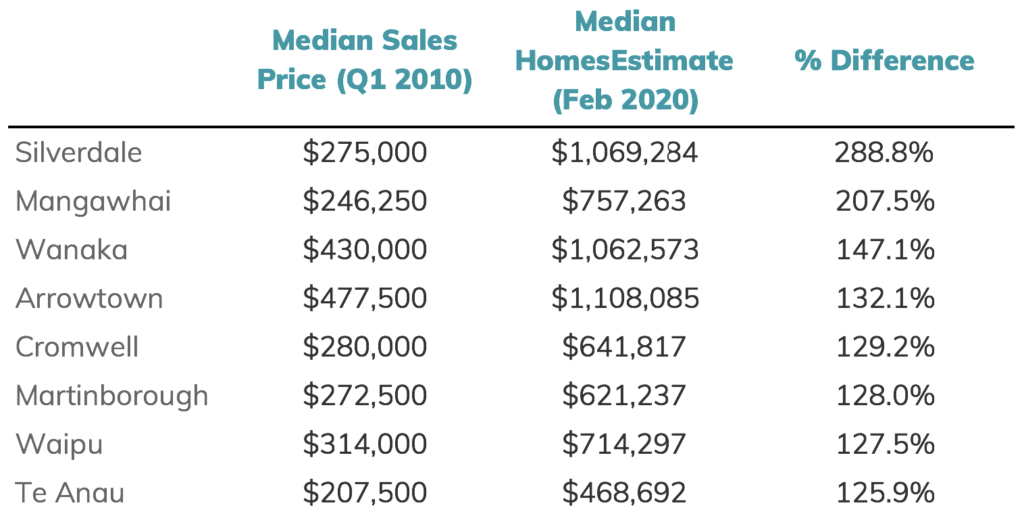

It’s now 2020 and we’ve looked back to where property prices were 10 years ago. The top-performing areas are dominated by new developing areas (such as Silverdale outside of Auckland) or towns in the deep south in Queenstown Lakes and Central Otago.

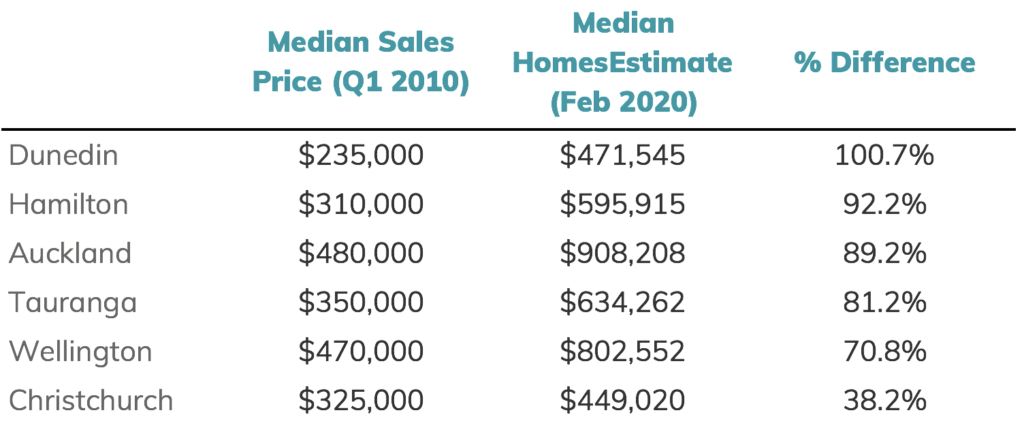

Of the main centres, Dunedin came out top with values more than doubled (just) in the last 10 years. Christchurch was the exception, however, with property values increasing by only 38%. The highest performing suburb in NZ’s main centres was Flagstaff in Hamilton where the median HomesEstimate is now $825k, up from a median sale price of $245k in Q1 2010.

Check out how prices have changed in your area below:

A few of NZ’s top performing properties last decade are listed below:

Te Anau – A bare section bought for $73k in February 2010 is now valued at $720k, an increase in almost 900%.

Whenuapai – A bare lifestyle section that was purchased for 2.275M in January 2010 and is now valued at $13.5M. An increase of over $11M.

Takapuna – A beachside Takapuna property purchased for $2.1M in March 2010, which is now valued at $8.28M. An increase of over $6M.

Wellsford – A Wellsford property purchased for $45k in February 2010, which is now valued $505k. The value has increased by more than 10x (or over 1000%).

Monthly HomesEstimate Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s February 2020 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

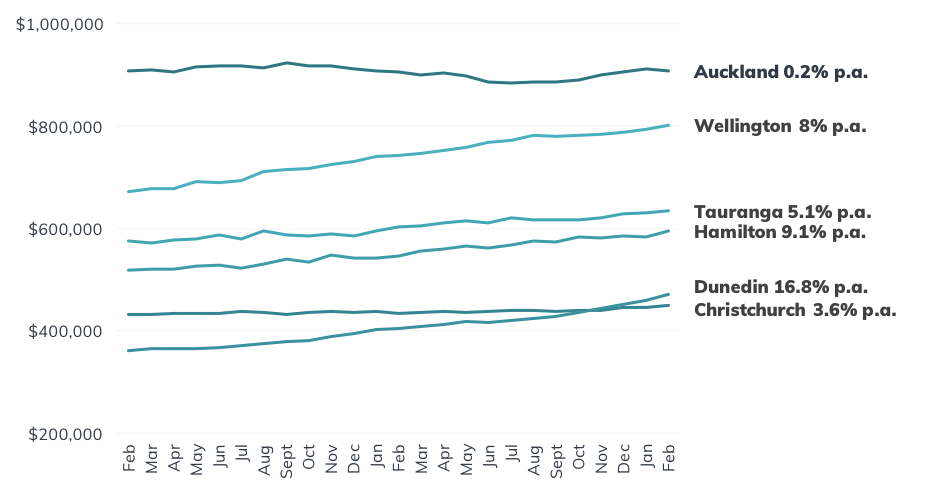

Trends in our Main Cities

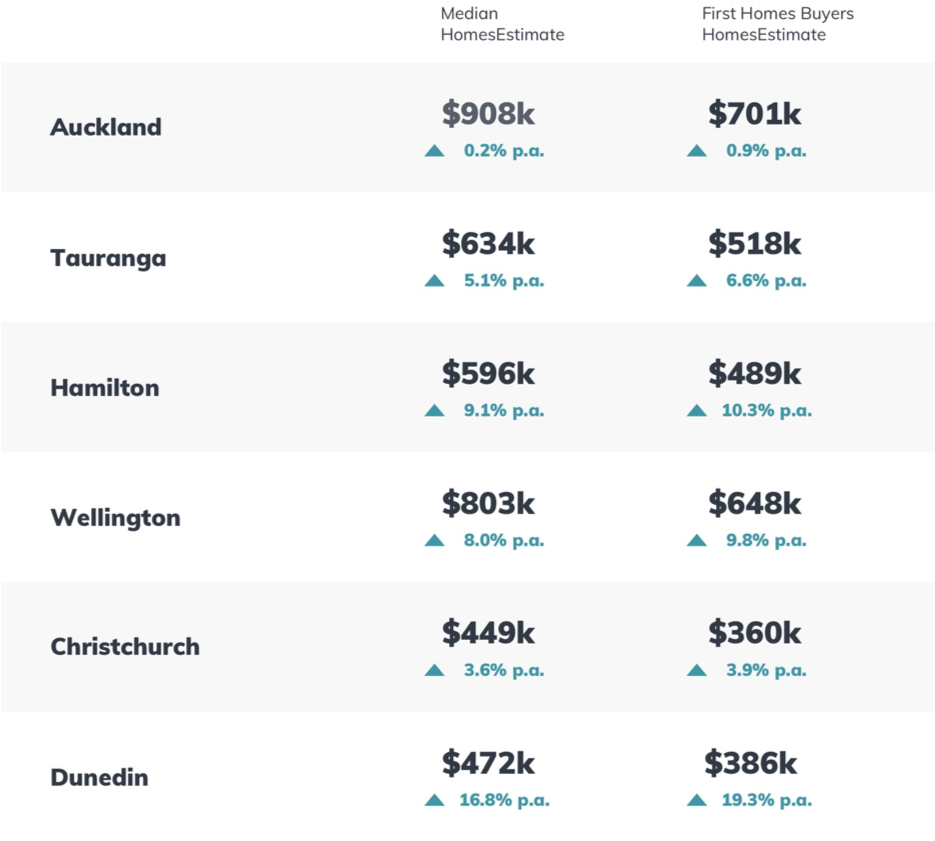

Property prices are strong across all of New Zealand’s main centres with an increasing trend across the board. Despite a slight dip in February to a median HomesEstimate of $908k, the Auckland market is also growing with the median HomesEstimate increasing by more than 2% in the last quarter of 2019.

We’ve also seen the median HomesEstimate in Wellington increasing to over $800k for the first time, up 8% from this time last year. The median HomesEstimate in Hamilton also increased strongly this month, up 9.1% p.a. to $596k.

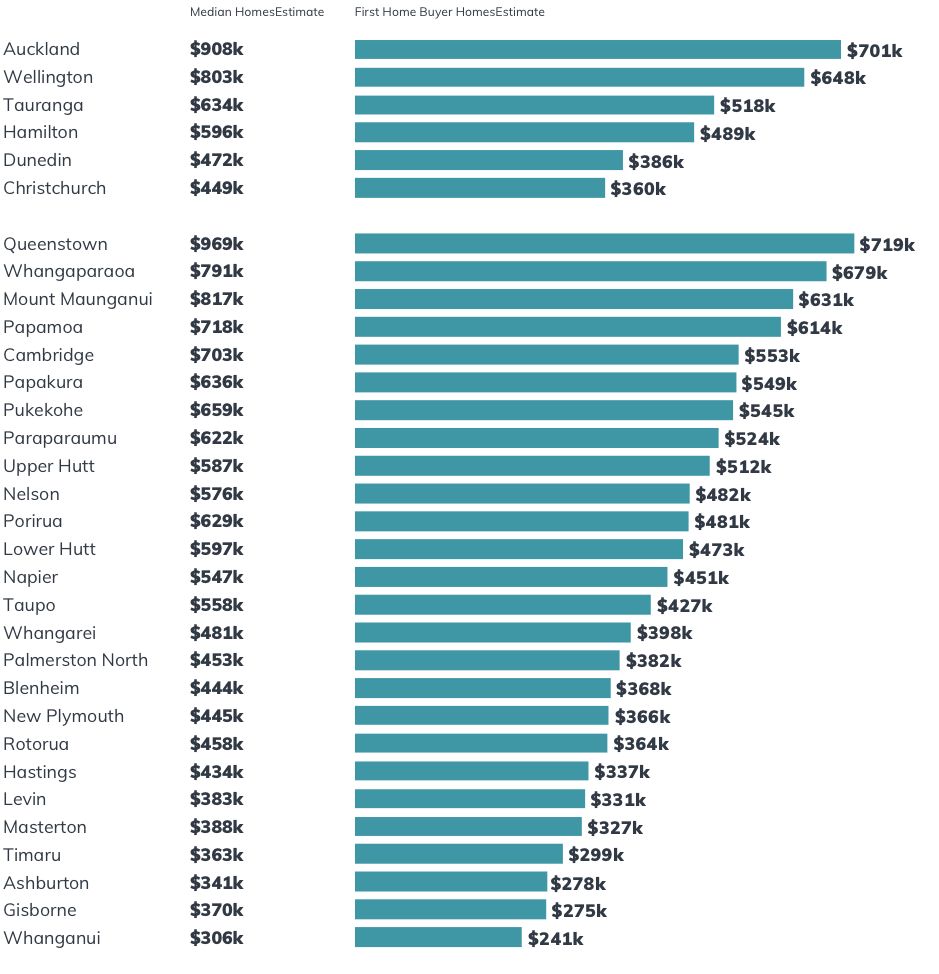

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.