You probably expect that I will write about this morning’s GDP (Gross Domestic Product) numbers which showed 1.6% shrinkage in our economy

during the March quarter. But the data are out of date, we know the June quarter will be a lot worse, we know that the June quarter finishes in a couple of weeks, and we can see that recovery is underway across a broad range of sectors of the economy.

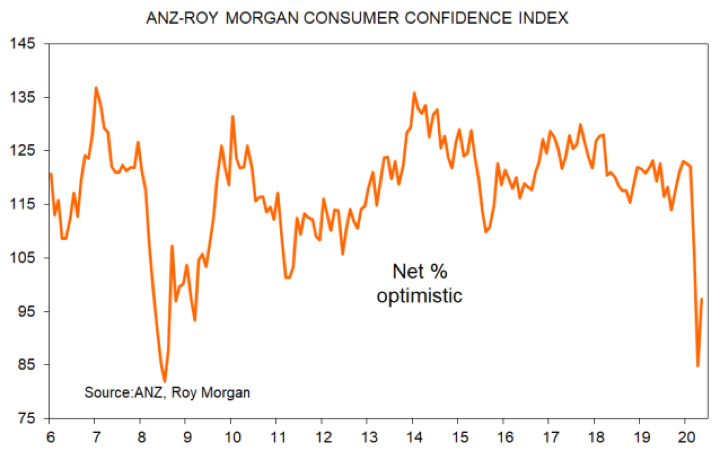

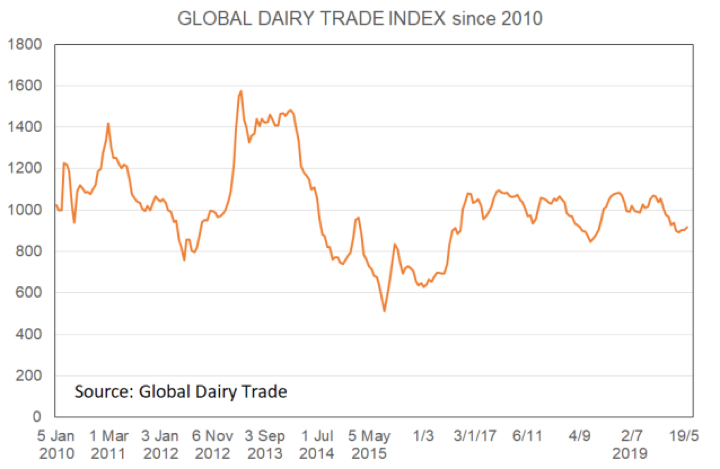

Confidence levels are improving from low levels, the housing market is not falling away price-wise to any major degree, and my various surveys show high levels of support, retail spending has recovered well, and even dairy prices have risen recently.

This means come the September quarter we will see a large surge in GDP, and when that number comes out it will be December and we’ll know a lot more about what 2021 will hold for us. Before we get there however, we will see a lot more bad news on the employment front, and it would pay to keep that in mind before one finds oneself expressing views which frankly may be impolitely too optimistic to those around you.

Housing Markets

Valuers give their views

Last week I sent out my monthly survey request to the valuers I can identify on my emailing list, asking them what they are seeing out there. I do this as a supplement to detailed information that comes in from real estate agents, and because the valuers look at the market through a slightly different lens.

Last month the responses centred around there being too few transactions to make any solid statements about how prices were going. Now, one month down the track, do we have more information in hand which they can convey to us? Yes.

Low to medium-end properties remain in high demand from both investors and first home buyers. The regions are holding up very well because of demand from those two groups. Buyers have definitely pulled back from new builds as have the banks; Housing NZ however is stepping into the breach.

There were 51 responses to the survey and the overall responses produced these net percentages for the formal questions.

This past month has the volume of enquiry for valuations gone up or down?

A net 24% of valuers said their volume of work has gone up. Then again, you’d probably get a strongly positive result for almost all business sectors in our economy at the moment when asked this question. The result was slightly more positive for the 22 residential sector specialists than the 19 commercial sector valuers.

Residential 23%

Commercial 16%

Is refinance work going up or down?

Residential 14%

Commercial 0%

A net 14% of residential valuers say that they are being asked for valuations by people looking for refinancing from a lender. This is stronger than for

commercial at a net 0%. This does not mean that no commercial valuer has been approached for a new valuation on a property by an owner looking for refinancing. Six said yes, six said no, the rest were neutral.

A net 14% of residential valuers say that they are being asked for valuations by people looking for refinancing from a lender. This is stronger than for

commercial at a net 0%. This does not mean that no commercial valuer has been approached for a new valuation on a property by an owner looking for refinancing. Six said yes, six said no, the rest were neutral.

Is the volume of “off the plan” construction valuations rising or falling?

Residential -32%

Commercial -37%

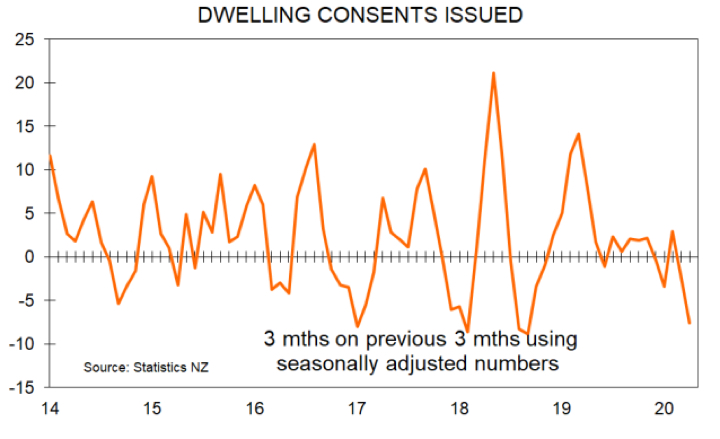

The picture is not a pretty one. Valuers in both residential and commercial sectors are seeing fewer requests to give their assessment on properties proposed to be built. This tells us construction will be falling away in both sectors. Over time this measure will allow us to make some statements about how severe the pullback will be. No commercial value saw more enquiry for off the plan valuations. So far, Statistics NZ data tell us that in seasonally adjusted terms dwelling consent numbers have fallen by 8% over the past three months. But we have seen such falls many times before and the true pullback in house construction will not show through for some time.

If you stood back a bit and thought about it honestly, are you valuing more conservatively or less conservatively than before?

Residential 41%

Commercial 89%

The valuers overwhelmingly say they have become more conservative in their valuations, especially for commercial properties. That is, they feel they are veering toward the low side for their price estimates

– which makes perfect sense in the current environment.

Do you feel prices are rising or falling at the moment?

Residential 18%

Commercial -42% And now we get something with some meat, even with just one month of formal survey results. Whereas a net 42% of commercial property values feel that prices in their sector are falling, a net 18% in residential feel that prices are rising.

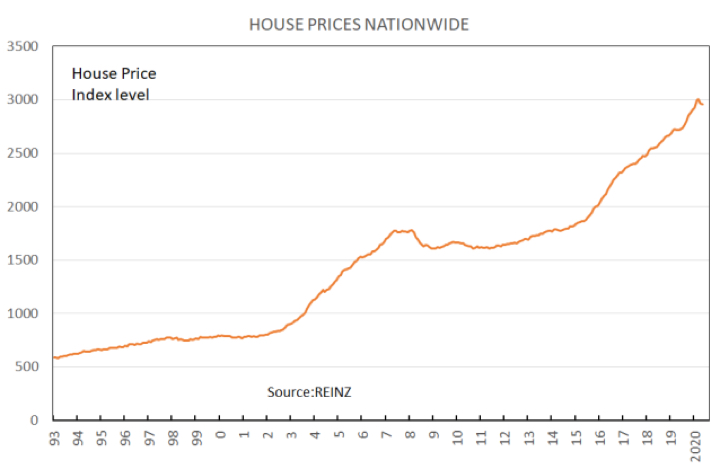

This is a very strong challenge to the prevailing view that average house prices are going down.

With regard to prices, we learnt early this week that average house prices around NZ, as measured by the REINZ’s House Price Index, fall by 0.5% in May after falling 1.7% in April. This 2.2% fall over two months is the biggest two month decline since late-2008. Will it continue? Although there are a great number of investors and first home buyers in the market looking for

properties, and although I believe the number of distressed sellers will be a lot smaller than people might think, it seems too early to say that average

prices have bottomed out.

And now we get something with some meat, even with just one month of formal survey results. Whereas a net 42% of commercial property values feel that prices in their sector are falling, a net 18% in residential feel that prices are rising.

This is a very strong challenge to the prevailing view that average house prices are going down.

With regard to prices, we learnt early this week that average house prices around NZ, as measured by the REINZ’s House Price Index, fall by 0.5% in May after falling 1.7% in April. This 2.2% fall over two months is the biggest two month decline since late-2008. Will it continue? Although there are a great number of investors and first home buyers in the market looking for

properties, and although I believe the number of distressed sellers will be a lot smaller than people might think, it seems too early to say that average

prices have bottomed out.

And now we get something with some meat, even with just one month of formal survey results. Whereas a net 42% of commercial property values feel that prices in their sector are falling, a net 18% in residential feel that prices are rising. This is a very strong challenge to the prevailing view

that average house prices are going down. With regard to prices, we learnt early this week that average house prices around NZ, as measured by the REINZ’s House Price Index, fall by 0.5% in May after falling 1.7% in April. This 2.2% fall over two months is the biggest twomonth decline since late-2008. Will it continue? Although there are a great number of investors

and first home buyers in the market looking for properties, and although I believe the number of distressed sellers will be a lot smaller than people might think, it seems too early to say that average prices have bottomed out.

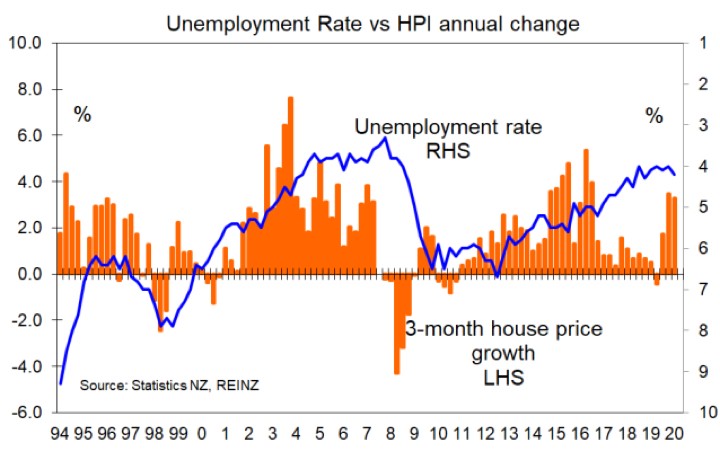

There is a correlation between changes in the unemployment rate and changes in average house prices, and with the unemployment rate set

to rise until the latter part of this year, that suggests time exists for house prices to pull back a bit further.

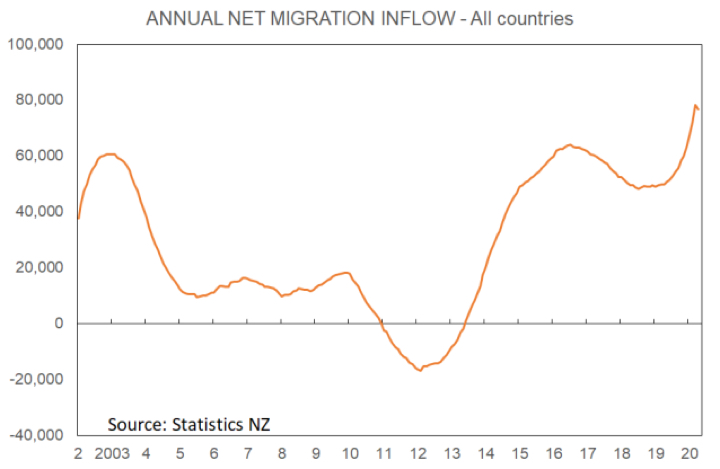

But the extent of price declines will be limited by a great number of factors, many of them covered in last week’s TV. They include record low interest

rates, money printing, spare cash from not travelling overseas, and net migration not falling by as much as people might think. This following graph shows the annual net migration inflow soaring even before lockdown.

In this week’s Tview Premium

- I examine what might be a structural shift in our net loss of Kiwis overseas which was happening before we heard of Covid19.

- Publish comments from real estate agents about their local markets around the country,

- discuss what FOMO means in the current circumstances, and

- look at results for Auckland’s 21 Wards from my survey with the REINZ.

Interest Rates

Tview Premium contains detailed graphs and analysis of rate alternatives for borrowers and term depositors.

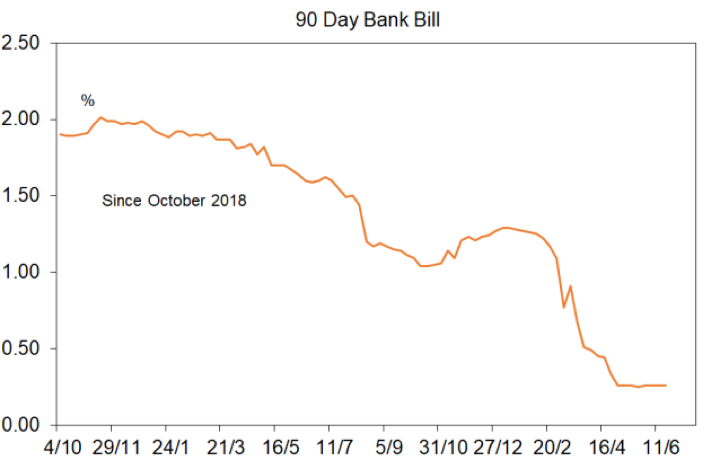

Wholesale interest rates have edged slightly lower this week, but not by enough to suggest any change in underlying trends or any greater scope

than existed last week for cuts in retail interest rates.

The one-year swap rate held steady at 0.26%, the three-year swap rate edged down to 0.29% from 0.32%, and the five-year rate went to 0.39% from

0.43%.

There are a couple of big forces in play if we look at our wholesale interest rates in terms of global developments. The first force is for rates to rise on

the basis of economies coming out of lockdown earlier, in better shape, and with greater increases in spending and economic activity than had been

anticipated. These developments reduce scope for further rate cuts by central banks, but because they could just be temporary bounce-backs from lockdown suppression, it is not certain that central bank thinking has really changed.

The other force is for rates to stay suppressed on the basis of central banks wanting to ensure that growth momentum returns. Central banks are explicitly choosing to take the risk that they inject too much stimulus into their economies over the coming year or two rather than too little.

We should expect that over coming weeks we will see more and more testing of central bank willingness to apply stimulus, not so much in terms of actions this year, but dates for when they will pullback their growth-driving efforts.

These are still very early days and the virus China gave the world still rages unchecked in many places. So, it seems much, much too early to be

thinking of yield curves steepening – which will happen when the end game is visible. But before the end of the year the risk is that medium to longterm interest rates in wholesale markets worldwide are sitting above current levels. But not yet.

If I were a borrower what would I do?

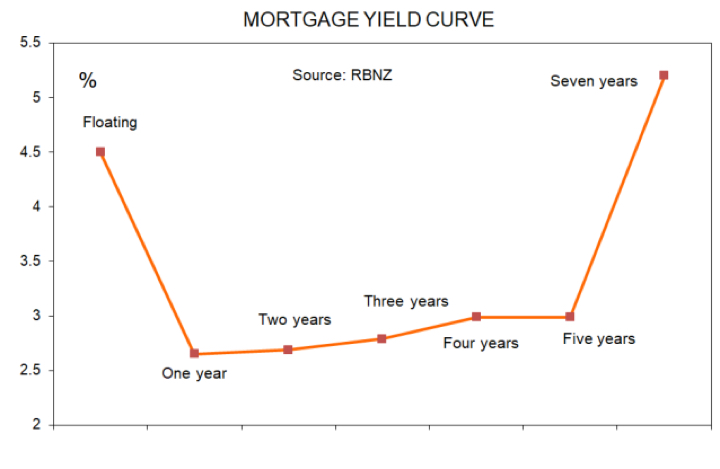

As noted last week, because I see interest rate risks shifting back upward later this year, and because I like rate certainty in an uncertain world,

I personally would be fixing most of my mortgage at a five-year fixed rate currently of 2.99%. I would fix maybe 15% for a much shorter time period in case I gained an ability to make an early repayment.

.

Subscribe here http://tonyalexander.nz/publications.php

This publication has been provided for general information only. Although every effort has been made to ensure this publication is accurate the contents should not be relied upon or used as a basis for entering into any products described in this publication. To the extent that any information or recommendations in this publication constitute financial advice, they do not take into account any person’s particular financial situation or goals. We strongly recommend readers seek independent legal/financial advice prior to acting in relation to any of the matters discussed in this publication. No person involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in this publication.