A cooling property market in some areas, particularly in Auckland, is good news for first home buyers. With low interest rates, and increasing restrictions on investors and foreign buyers, it is as good a time as any for first home buyers to get into the market. This is reinforced by recent research by Corelogic indicating that the proportion of property purchases by first home buyers is increasing around New Zealand.

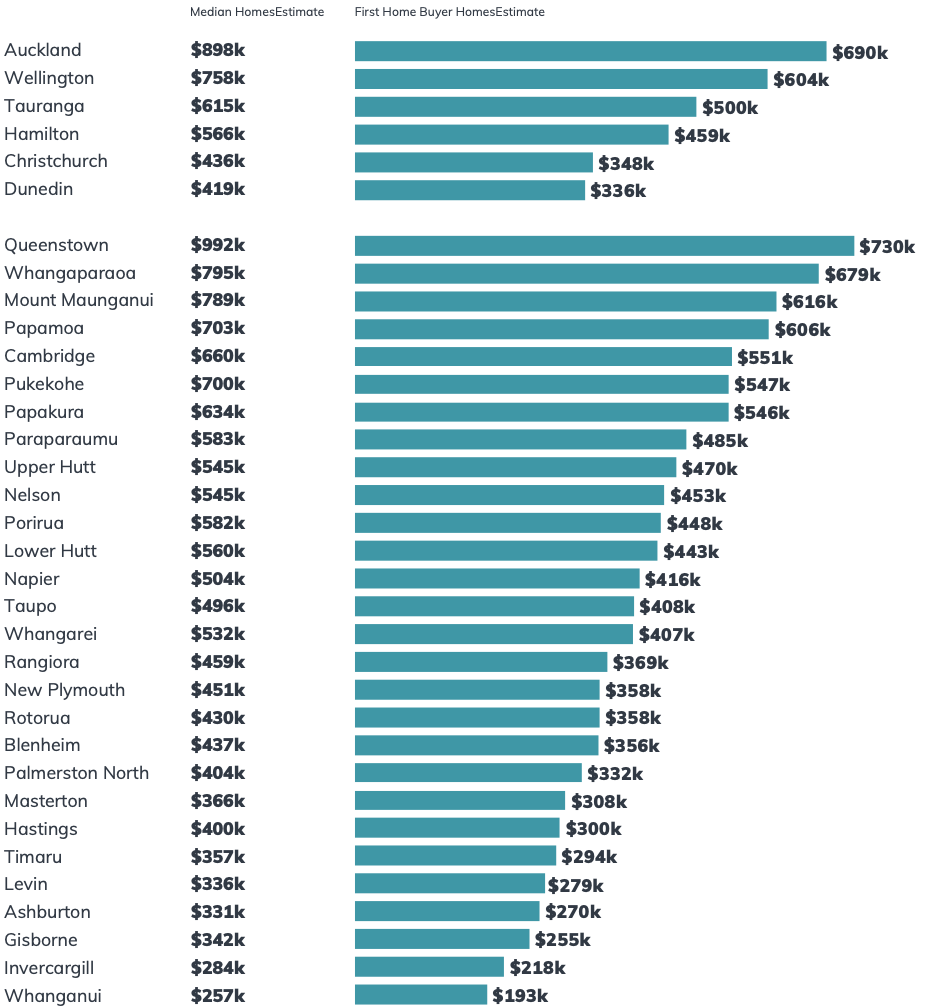

With the “First Home Buyer HomesEstimate” ranging from near $700k in Auckland and Queenstown to more affordable figures in the regions, the question is what can first home buyers expect to buy, where can they afford and what can they expect for their money.

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost and is calculated to be the lower quartile HomesEstimate in a town.

What can First Home Buyers expect?

To determine what a typical first home buyer could expect around the country, we’ve considered all sales in the last 12 months less than the First Home Buyer HomesEstimate and highlighted features of these properties and the suburbs where they occur.

Although the price point changes around the country, the type of properties accessible to first home buyers is relatively consistent. Most could expect a small central apartment (often with less parking options) or an approx. 100m2 house in some of the cities lower value suburbs.

See a breakdown of your area below:

Auckland – Considering recent sales less than $690k. Options at these prices include small apartments in Auckland Central or Grafton, or houses in Auckland’s southern and western suburbs. For those considering apartments in Grafton, be aware that only 17.7% of these sales had parking included.

Tauranga – Considering recent sales less than $500k. Without the stock of apartments, most first home options are houses of approx. 100m2 in Tauranga suburbs, and parking is not guaranteed.

Hamilton – Considering recent sales less than $459k. Those apartments that are available are larger than those in Auckland, but first home options appear to be mostly houses of approximately 90m2 in the Nawton/Frankton area.

Christchurch – Considering recent sales less than $348k. First home buyers can expect more for their money in Christchurch with a First Home Buyer HomesEstimate of $348k. There are more apartment options here and the majority of properties have parking available.

Dunedin – Considering recent sales less than $336k. The first home options are largely restricted to Dunedin’s southern suburbs. However, in contrast with Christchurch, parking is more uncommon.

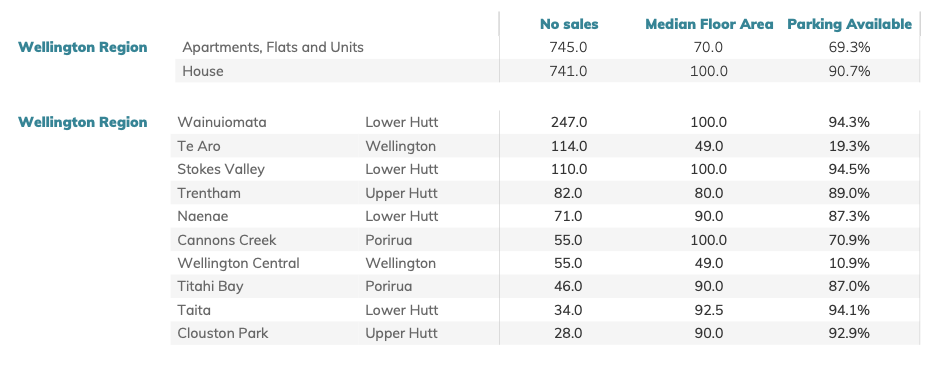

Wellington – Considering recent sales less than $604k. The most common properties are Apartments in the central Te Aro and Wellington Central suburbs. There are relatively few first home buyers in Wellington’s suburbs as it appears first home buyers are instead looking to bordering areas in the region instead, such as Upper Hutt, Lower Hutt and Porirua.

Wellington Region – Considering recent sales in Wellington, Upper Hutt, Lower Hutt and Porirua less than $492k. For those living in the Wellington region, most first home options exist in the nearby Lower Hutt suburbs and first home buyers in this area now have a 38% market share.

May Property Update

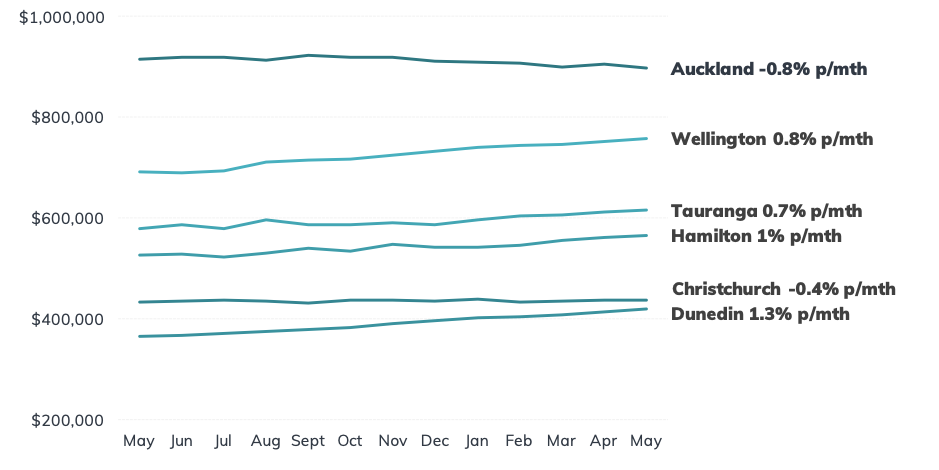

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s May 2019 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

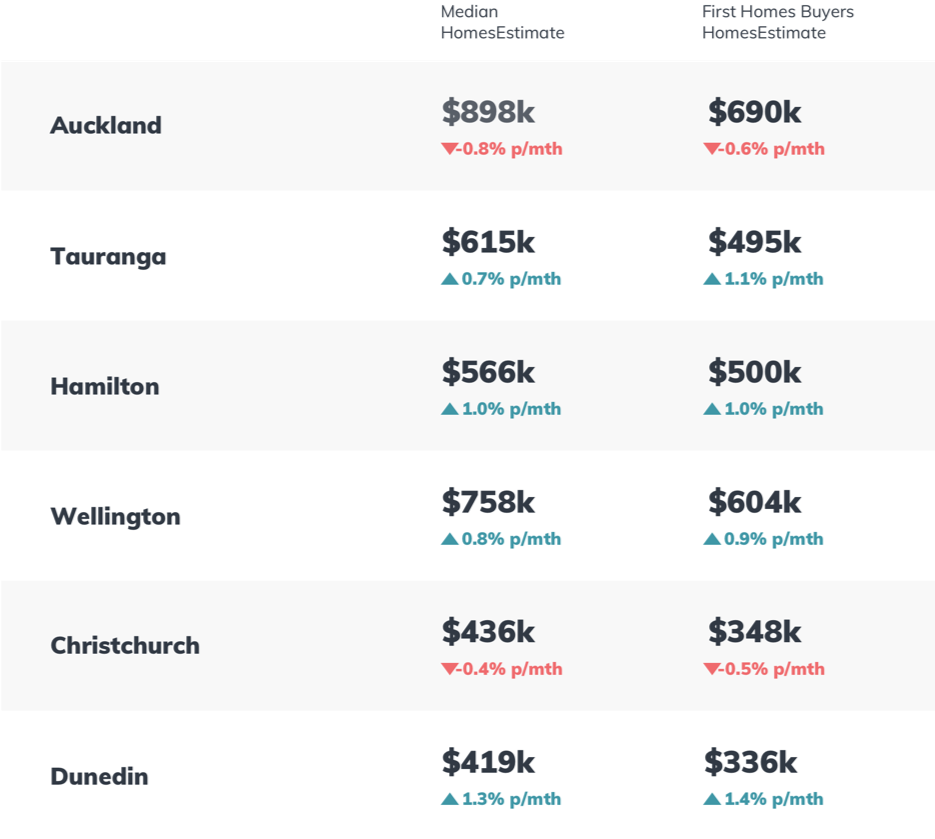

We are seeing some life in the Hamilton and Tauranga markets with the median HomesEstimate increasing by 1% and 0.7% this month. This is following relatively high sales prices during the back-end of summer. This contrasts with their big city neighbours where the median HomesEstimate continues to decrease in Auckland.

The property battle in the South Island continues as the median HomesEstimate in Dunedin is up 1.3% this month to $419k, only $17k behind the Christchurch’s median HomesEstimate of $436k. The gap between these cities is clearly closing and the question is whether Dunedin will catch up and surpass Christchurch before the year is out?

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.