Opportunities for First Home Buyers?

When is the best time to get onto the property market? And where should First Home Buyers be looking? As a relatively new homeowner myself, I understand the challenges of getting into the property market.

This month, the team at homes.co.nz have looked at our First Home Buyer HomesEstimate to identify the more affordable suburbs around the country and asked the experts what their advice is for First Home Buyers.

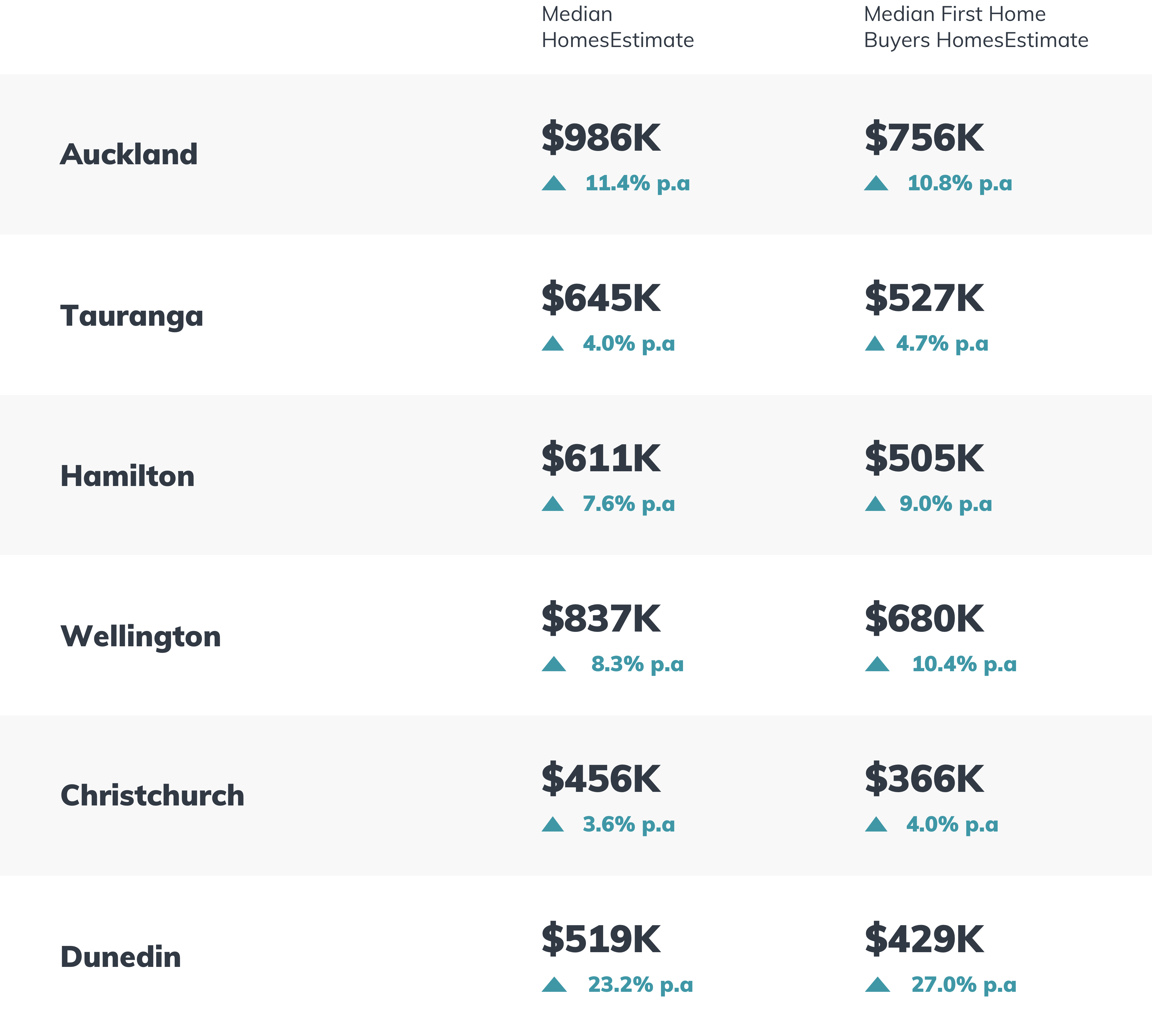

The First Home Buyer HomesEstimate is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town, which means 25% of properties in a town on homes.co.nz are valued less than this estimate. This estimate can be surprising to many, and highlights that there are plenty of options available, especially if buyers know where to look! Unsurprisingly, Auckland is the most expensive of NZ’s main centres with a First Home Buyer HomesEstimate of $756k. This is followed by Wellington ($680k), Tauranga ($527K), and Hamilton ($505K) where First Home Buyers can expect to pay more than $500k. The most affordable city is Christchurch where a First Home Buyer HomesEstimate of only $366K.

We talked to Treena Duncan, Head Agency Officer at Ray White New Zealand, who suggested it was a great time for First Home Buyers.

“With interest rates at all-time lows – now advertised from 2.6% – and banks being supportive of property purchases, we are seeing many buyers wanting to take advantage of these factors. Obtaining secure credit on excellent terms while they are available is a driver for first home buyers to purchase property now.”

Treena says it’s important for First Home Buyers to define exactly the type of home you are looking for and to prepare a list of your non-negotiables. “It may be you have pets and so main roads are a no go for you, or that due to your family size it must have four bedrooms. Or perhaps you are keen on DIY so are looking for a place that you can do up.”

“Depending on your desired location and budget and whether or not your first home is an investment or to make your own, there are varying price points across the country to suit your needs. Some first home buyers will qualify for a first home grant through Kiwi-Saver and we recommend a good mortgage broker and lending pre-approval prior to entry into the market. Do your research and be prepared and positioned to buy now to eliminate competition.”

Explore the most affordable suburbs in your town below. These include not only suburbs on the town fringe, but also central suburbs where Apartment living provides great opportunities for First Home Buyers.

Monthly HomesEstimate Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s July 2020 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

Contrary to what many were predicting, property prices are remaining resilient for now. The median HomesEstimate in Auckland has now increased by 11.4% from its low of 12 months ago. Increases here and in other main centres are largely due to strong sales activity in Q1.

Although we haven’t seen our HomesEstimates decrease significantly yet, we are seeing lower sales volumes than normal as homeowners and buyers are sitting tight. It will be interesting to see if trends start to shift (as many Economists are predicting) as this sales data becomes available. We are yet to see the impact of COVID-19 on the property market, but for now it is hanging in there!

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.