Pay less than $400k in Auckland’s Double Grammar Zone?

Christmas has been and gone, and now many parents around the country are looking forward to their kids heading off to school for another year. Although this ‘free’ childcare may be a relief for some parents, for others the stress of finding accommodation in the preferred school zone can be very stressful.

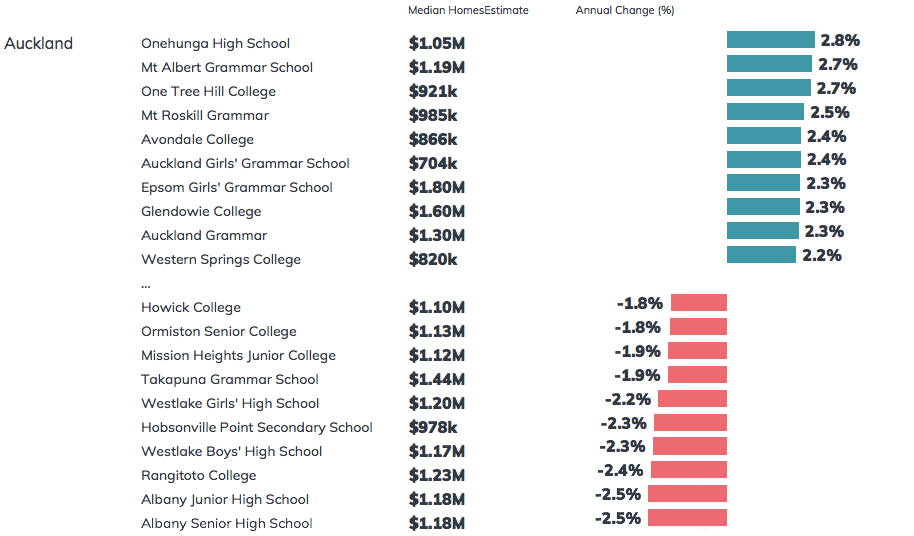

This month homes.co.nz has looked at the value of property in many school zones around the country. The most expensive school zone in the country is Epsom Girls’ Grammar School where the median HomesEstimate of in-zone properties in $1.8M. This is followed by Glendowie College ($1.6M) and Takapuna Grammar School ($1.44M).

Outside of Auckland, the most expensive school zone is Wellington Girls’ College with the median HomesEstimate of $850k, up 6.3% from this time last year. Check out property prices in school zones near you below.

Properties “double-zoned” for Auckland’s top boys’ and girls’ schools demand an even higher premium. The median HomesEstimate in the double Auckland Grammar / Epsom Girls Grammar School zone is $1.83M, which is more than double the median value in Auckland. If this school zone is for you, but you don’t have this type of cash, apartment living may be your best bet.

The cheapest sales of properties in the ‘Double Grammar’ zone in 2019 are all small apartments or flats, but some are selling for less than $350k:

Monthly HomesEstimate Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s January 2020 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

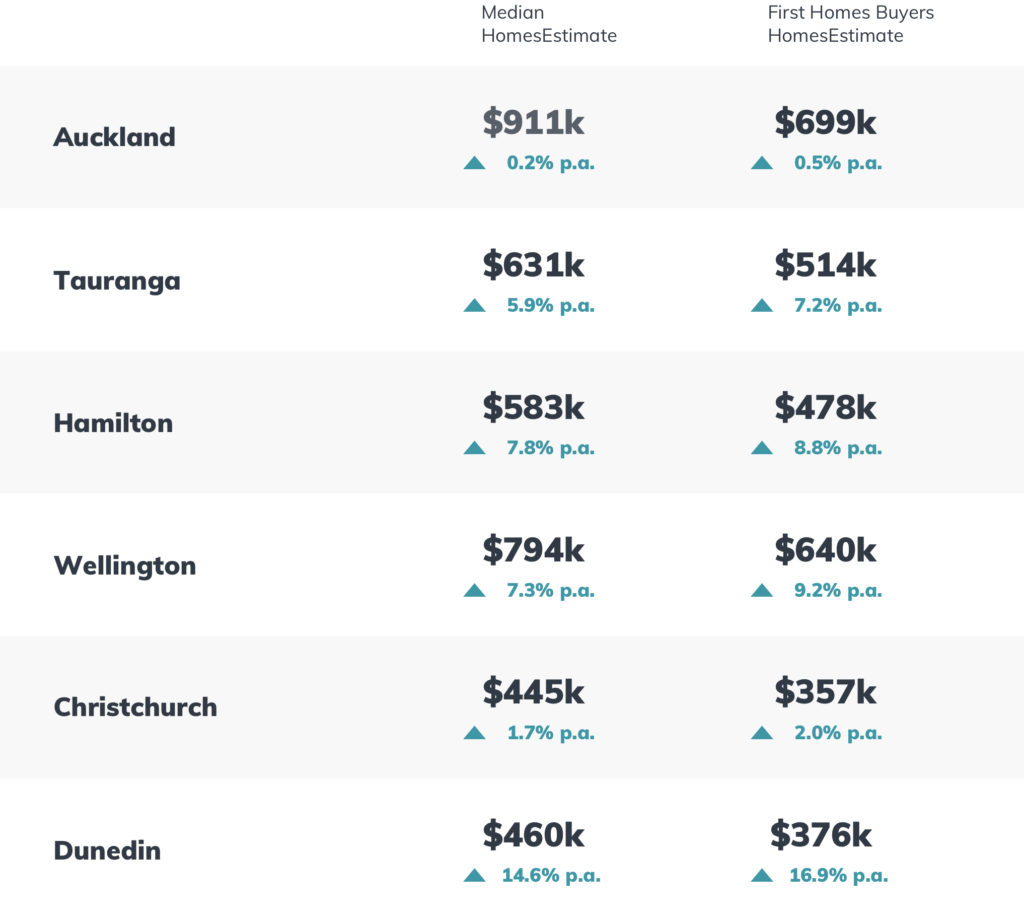

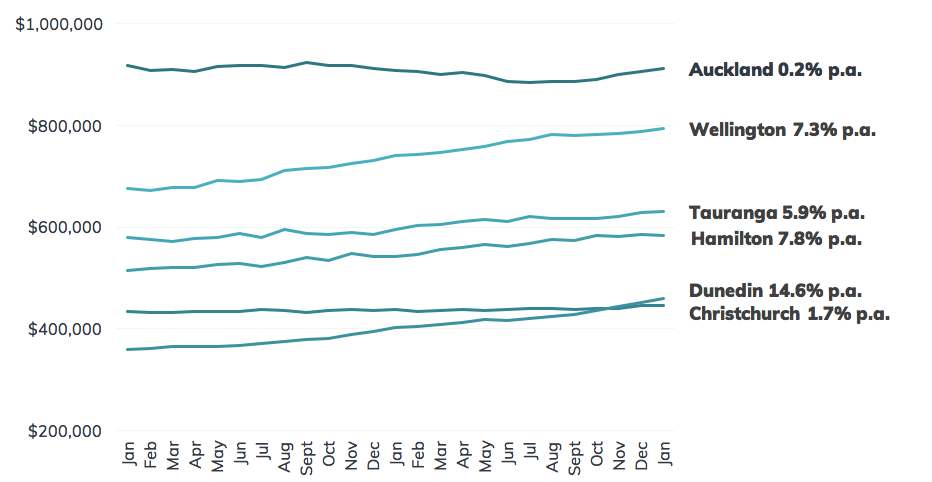

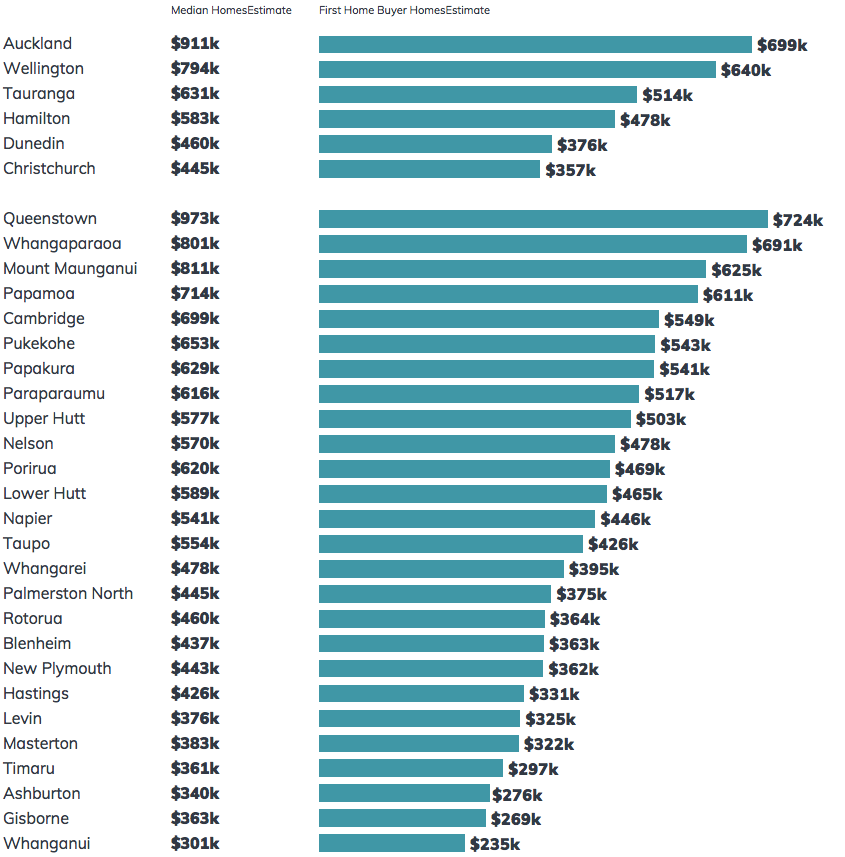

With Auckland prices continuing to increase, the median HomesEstimate has now increased in all of NZ’s main centres in the last 12 months. The median HomesEstimate in Auckland is now $911k, up 0.2% from this time last year.

The Wellington and Dunedin markets are the strongest performers with median HomesEstimates of $794k (up 7.3%) and $460k (up 14.6%), respectively.

The peak selling time is ahead of us, so we expect these positive trends to continue for the rest of the summer months.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.