The waterfront premium around New Zealand

While sitting on the beach this summer, did you find yourself looking around the nearby waterfront properties and dream? The team at homes.co.nz did too, and unfortunately the value of these homes often comes with a hefty waterfront premium.

It is no surprise that many of NZ’s summer hotspots see some of the largest waterfront premiums. Mount Maunganui tops the list with the median HomesEstimate of properties within 50m of the ocean valued at over $2.3M, almost 150% above the town’s median. Other towns with significant premiums for waterfront properties include Russell in the Bay of Islands and Picton in the Marlborough Sounds. Rotorua beats out Taupo for the biggest lakeside premiums with the median HomesEstimate of properties within 50m of Lake Rotorua being $942k.

Russell also saw the most expensive waterfront sale in 2020 with 49 Okiato Rd selling for $7M in February. The most expensive sale within 100m of the water was 7 Rarere Rd in Hauraki, which sold for $12.25M

There are also 4 suburbs in Auckland that have a waterfront club requiring a $4M entry fee. The median HomeEstimate for properties within 50m of the water in Campbells Bay, Parnell, Milford and Orakei all exceed $4M, with Campbells Bay topping the list with a median HomesEstimate of $5.19M, 166% above the suburbs median of $1.95M.

There were also a few surprises, indicating that being waterfront isn’t everything. Waterfront properties in Wellington’s Roseneath and Seatoun, for example, actually see a waterfront discount. Potential reasons for this include a higher premium being placed on views or the additional upkeep required for waterfront properties.

Another aspect to consider is the ongoing impact of climate change and potential difficulties in insuring waterfront properties. Homes.co.nz recommends you talk with your insurance company if considering a waterfront dream. We reached out to the folks at Insurance Council of New Zealand to see what their thoughts were:

“Property owners need to take a long view of the impacts of climate change, including sea level rise, storm surges and flooding, may have on their property. The cost and availability of insurance as well as the impact that may have on property prices are among the considerations that should be taken into account.”

Tim Grafton, Insurance Council Chief Executive

Monthly HomesEstimate Property Update

Trends in our Main Cities

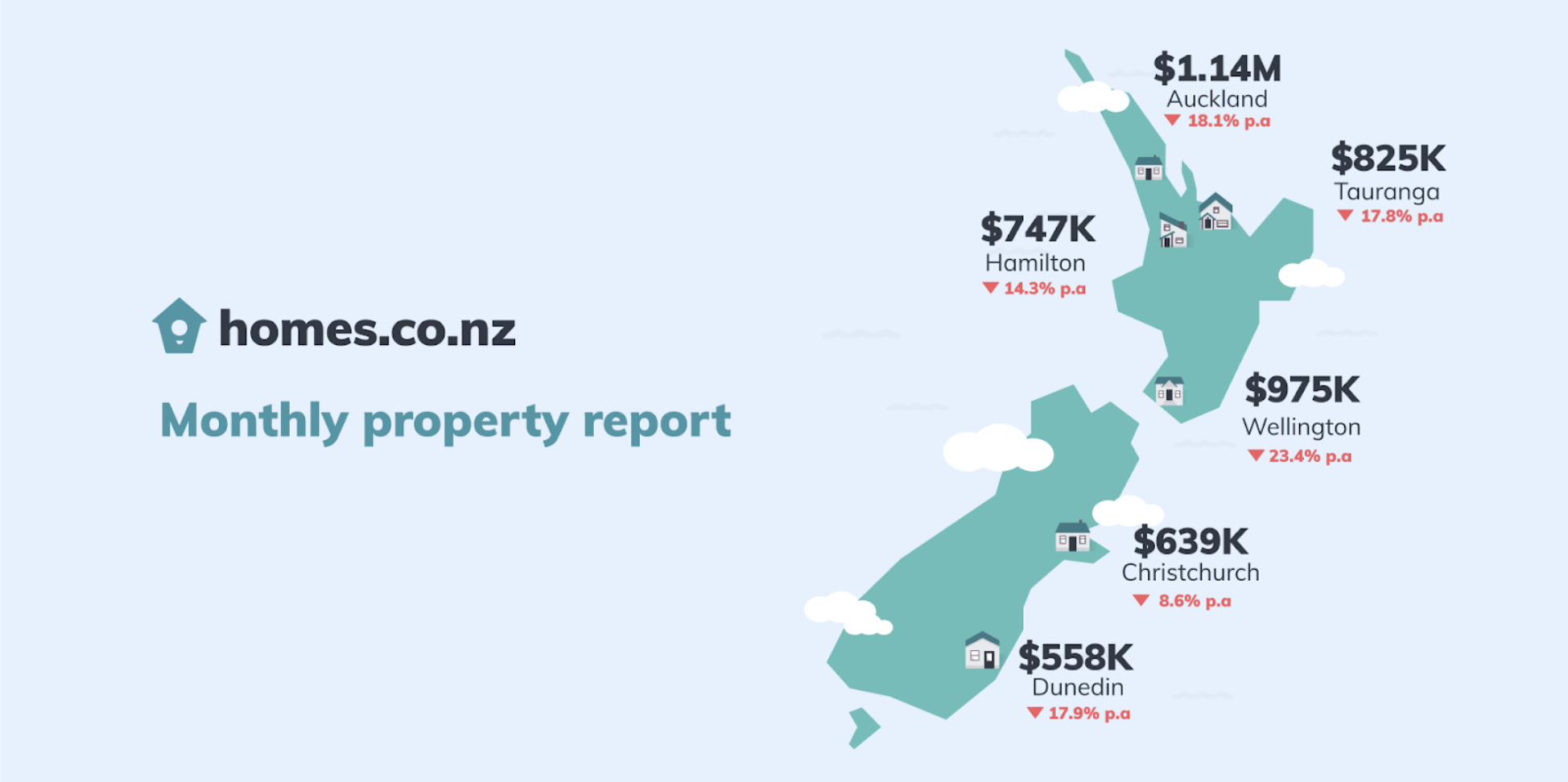

We are seeing more of the same this month with the median HomesEstimate continuing to increase right across NZ’s main centres. The median HomesEstimate in Wellington is now $937k (up 18.1% p.a.) and is well on the way to joining Auckland with a median property value exceeding $1M.

One of the reasons for prices continuing to increase, is a limited stock of properties on the market. Many regions are reporting a record low volume of listings, and without any significant changes on the horizon, expect current trends to continue.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.