Summer is well and truly upon us, and if you’re thinking about putting your house on the market in 2023- we’re here to help set the wheels in motion.

To start you off, here are six simple steps to get your house sale-ready:

- Make necessary repairs – Before putting your house on the market, address any repairs that need to be made. Fix leaky faucets and replace old appliances. It’s amazing what a difference a fresh coat of paint can do! Is the garden looking messy? Pull up the weeds or hire a gardener to give it a tidy up.

- Clean and declutter – While your house is on the market, you want to make it appealing for buyers to walk through . Start with a clean house – we mean deep clean every room, including the floors, walls, and windows. And while you’re at it, declutter so it’s easy to maintain the cleanliness. Removing clutter will also make the house feel more spacious and open to buyers.

- Stage your home – Consider who your property will ideally appeal to. Your agent will help you with this so listen to their advice. Will it be a small family, a bachelor, or a DIY guru? Try to set the scene with props like furniture and art to help them picture their vision. If you don’t have the time or capacity to do this yourself, home staging companies can be a great option and are increasingly popular. They’ll present your home in the best light possible, using furnishings to suit the character of your home.

- Take good photos – High-quality photos are crucial when it comes to selling your home, as your agent will tell you. It’s a no-brainer to invest in a professional photographer who’ll present the property in the best light, and help you market the home online. If you really want to do it yourself, we recommend researching how to take top quality photos.

- Price your home correctly – One of the most important factors in selling your home is pricing it correctly. Research the prices of similar homes in your area using our homes.co.nz HomesEstimate. This will provide you with a property price estimate based on market values, the rateable value, sales histories, property size and what year the house was built.

- Contact real estate agents – Reach out to real estate agents as early as possible, they have the local knowledge and experience to guide you through the process and can help you market your home to potential buyers. Selling privately is an option, but you’ll miss out on the agents database of buyers, their agent networks and their marketing nous.

This information is not intended as a complete guide, as it doesn’t consider your individual needs or financial situation. Homes.co.nz accepts no responsibility or liability for any inaccuracies or omissions in the content. Always obtain independent legal advice before buying or selling property.

Monthly Property Update

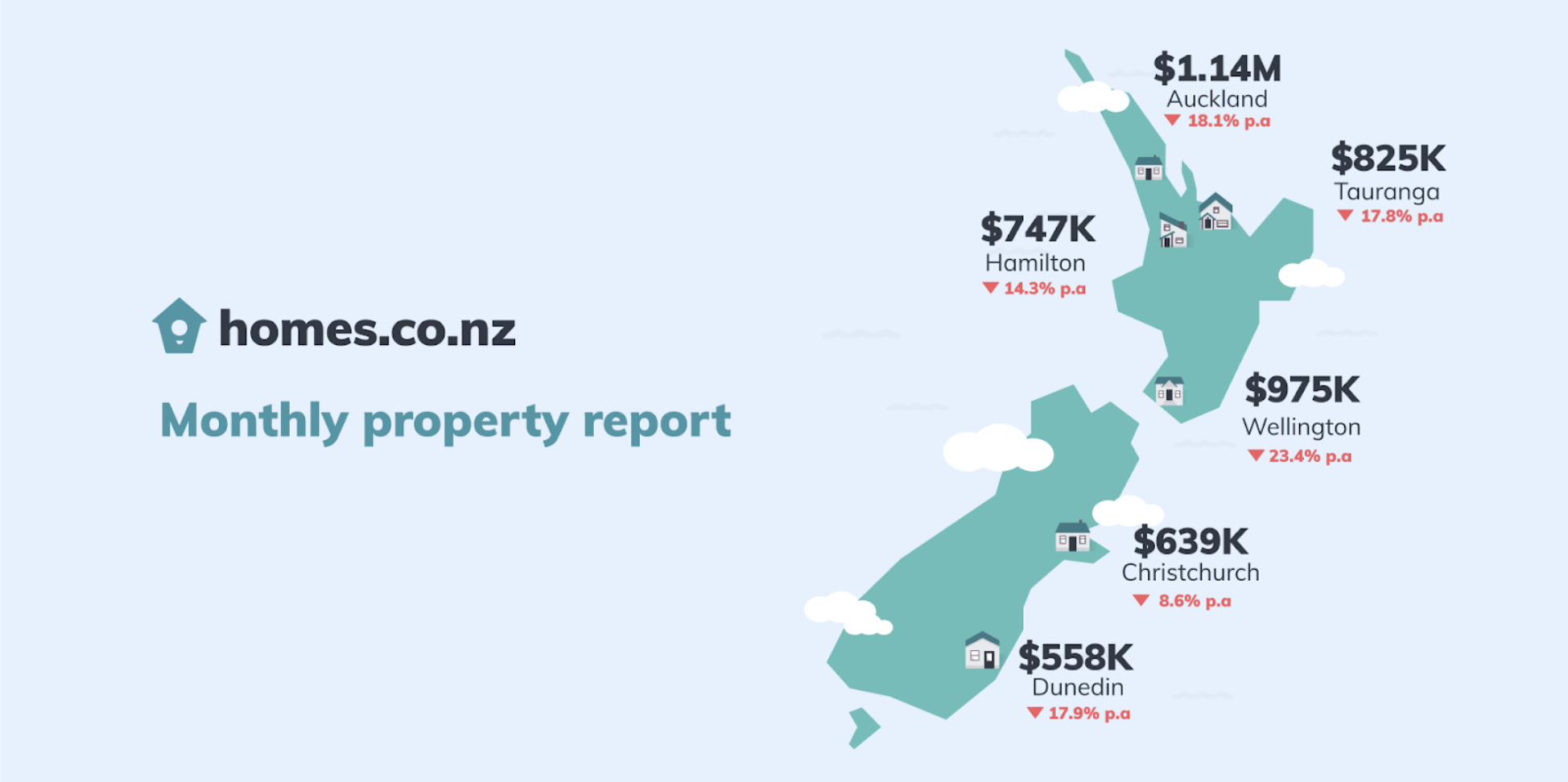

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s December 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

The median HomesEstimate appears to be levelling, with Auckland and Tauranga showing small increases compared to last month. This will be welcome news for homeowners, almost a year on from the property market peak in February 2022.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It ‘is calculated to be the lower quartile HomesEstimate in a town.