You have gone to the bank to sort your pre-approval, researching properties online and visiting open homes in the weekends. You have soon realised that you need to change your expectations on the home you’re going to end up with, due to what you can afford. You eventually find a home and not long after moving in, invite friends over to celebrate. You start chatting about becoming homeowners and they excitedly show you the house that they have just made an offer on. It’s one of the houses you looked at and loved but weren’t able to afford. You tell them you remember looking at the same home, but that it was outside of your budget. Your friends go on to tell you they didn’t think they could afford it either until they decided to go and have a chat with a mortgage advisor.

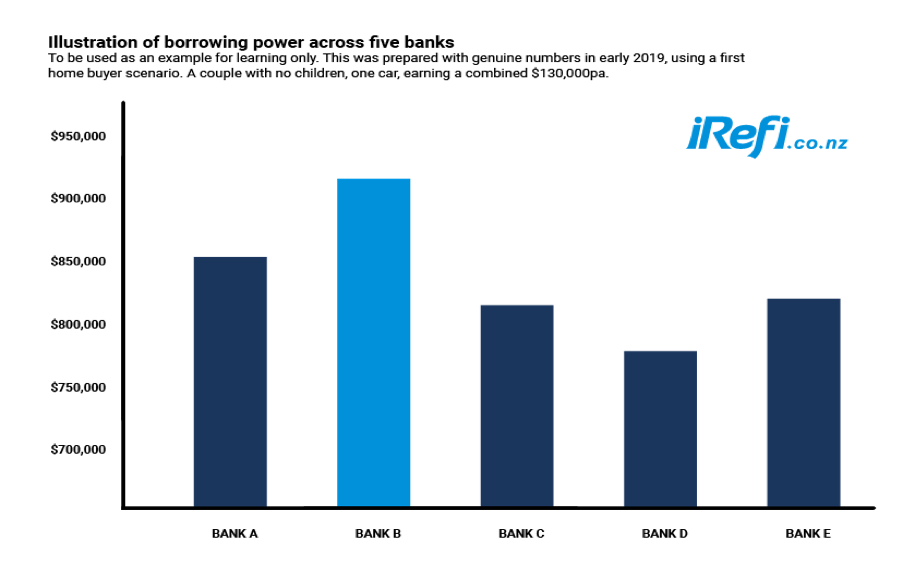

If you go from one bank to the next to find out what they will approve for you in terms of lending you will likely get vastly different answers.

Your ‘borrowing power’ is a number that changes regularly with your income amount, income type, your age, the number of cars you own, the number of dependents you have as well as other variables. When you work with a mortgage adviser, they have access to the servicing calculators across all the banks, meaning you get access to all the main lenders through one independent person.

The bank does not calculate your affordability based on the advertised rate, currently around 3.5%, but a ‘servicing test rate’, currently around 7% and dropping for some banks.

A common misconception is if you can afford $700 a week in rent you will be able to get a mortgage that is about the same amount. In some ways this is true but really what the banks want to understand is your uncommitted monthly income (UMI). They use your UMI and the ‘servicing test rate’ to determine your borrowing power.

The trick to ensuring you maximise your borrowing power based on your situation is to work with a mortgage adviser who has an agency with all the banks. Mortgage Advisers understand which of the lenders’ internal formulas will best suit the strengths and weaknesses of your application.

To discover your borrowing power use iRefi’s online mortgage calculator which will also show you potential mortgage savings over the lifetime of your home loan.

For more check out their YouTube videos and Reviews on Facebook.