With property prices increasing as they have, it comes as no surprise to see large increases in suburb median values around the country. Core Logic’s latest insights** suggest that there are now only 150 suburbs nationwide with median values less than $500k (61 in the North Island, 89 in the South).

However, it’s not all doom and gloom for first home buyers. Although tracking median values provides a good indication of the direction the market is heading in, it’s important to remember that you can expect half of all properties to sell for less than this value.

In Auckland, for instance, there were 10 Auckland suburbs where more than 10% of this year’s sales were for less than $500k and 66 suburbs where more than 10% of sales were for less than $750k. This includes Auckland Central where almost 48% of all sales this year were for less than $500k. This highlights that although the median values may be getting out of reach, there are still affordable options in most suburbs.

There is a similar story in Wellington where Wellington Central has seen over half of sales this year being for less than $500k. Even in the desirable suburb of Brooklyn (with a median HomesEstimate of $1.3M) still has seen 15% of sales this year at a more affordable price.

There are more affordable suburbs in Christchurch and Dunedin with 22 suburbs having more than 50% of sales this year being less than $500k, although all but 2 of these are in Christchurch. Top of the list is Aranui in Christchurch where over 90% of sales have been for less than $500k.

Things get a bit more pricey in the North Island, but there are still 22 suburbs in Hamilton and Tauranga with more than 50% of sales this year selling for less than $750k.

And for those interested in where the most affordable areas are outside of the main centres… The most affordable town (with 100 or more sales this year) is Westport, where 93.9% of this years sales have been for less than $500k. Other top contenders include Tokoroa, Greymouth, Temuka and Gore.

The key message for First Home Buyers is to not give up. Yes – property prices are trending upwards, but affordable options continue to exist.

** Core Logic’s latest “Mapping the Market Report” here.

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s September 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

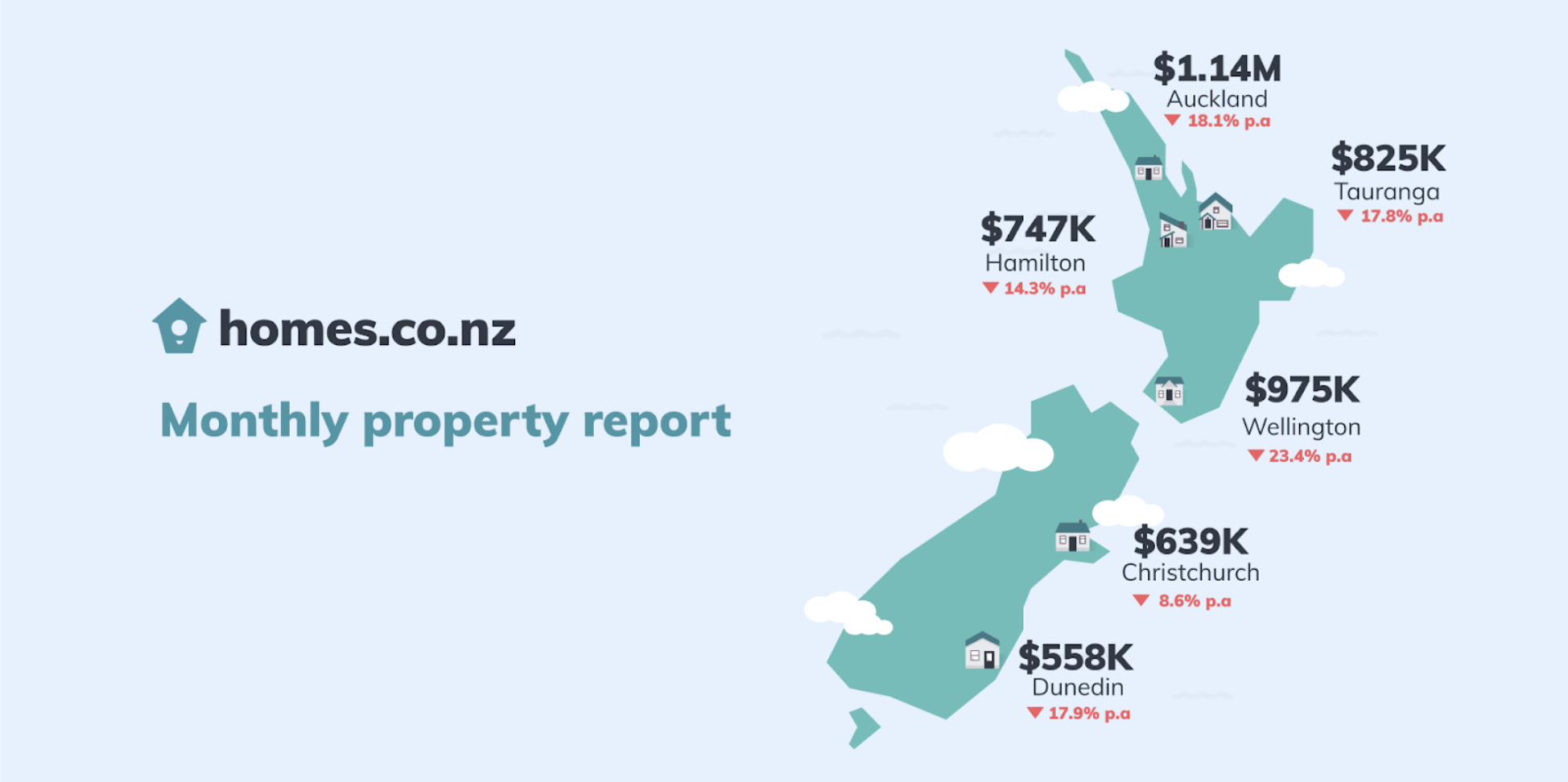

Trends in our Main Cities

See the median HomesEstimate across New Zealand’s main centres below.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.